이미지 확대보기

이미지 확대보기구글의 지주회사인 알파벳 (Alphabet)은 25일 뉴욕증시에서 2분기 실적을 공개했다.

그 중 판관비와 영업비용을 뺀 영업이익은68억 6800만 달러에 달했다. Operating income $6,868

영업외수지를 차감한 순이익은 62억 6000만 달러이다. Net income $6,260

주당 수익은 $8.90이다.

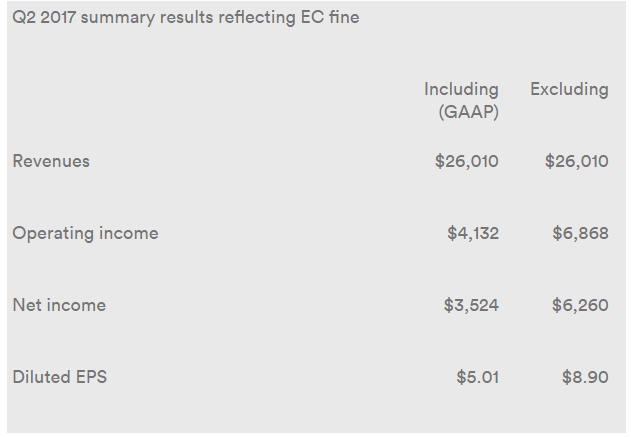

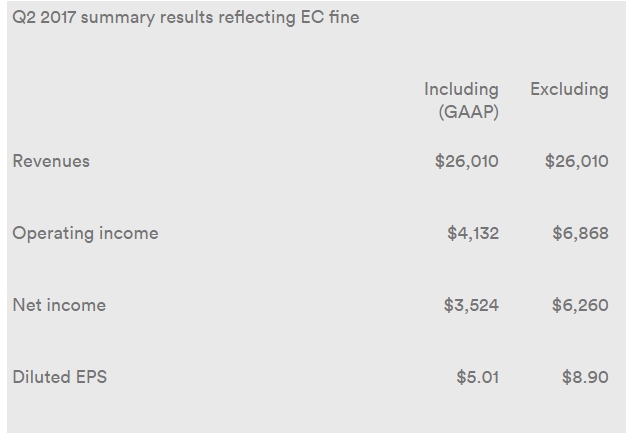

문제는 유럽연합 과징금이다.

과징금을 차감하면 2분기 영업이익은 43억 3200억달러로 줄어든다. Operating income $4,132. 순이익도 35억 2400만 달러로 축소된다. Net income $3,524 . 벌금을 차감한 주당 순이익은 주 5.01달러 이다. Diluted EPS $5.01.

Including (GAAP) Excluding

Revenues $26,010 $26,010

Operating income $4,132 $6,868

Net income $3,524 $6,260

Diluted EPS $5.01 $8.90

이미지 확대보기

이미지 확대보기다음은 구글 발표문

Alphabet Inc. (NASDAQ: GOOG, GOOGL) today announced financial results for the quarter ended June 30, 2017.

"With revenues of $26 billion, up 21% versus the second quarter of 2016 and 23% on a constant currency basis, we're delivering strong growth with great underlying momentum, while continuing to make focused investments in new revenue streams," said Ruth Porat, CFO of Alphabet.

Q2 2017 financial highlights

In order to facilitate comparison of current quarter performance to prior periods, this summary table highlights the impact of the $2.7 billion European Commission (EC) fine, which was accrued in Q2 2017:

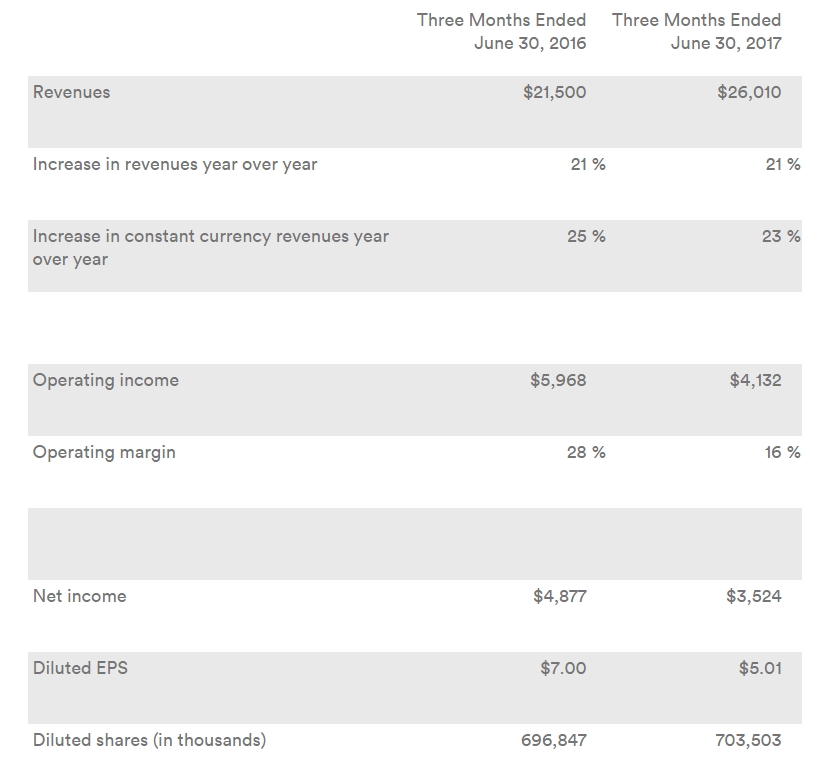

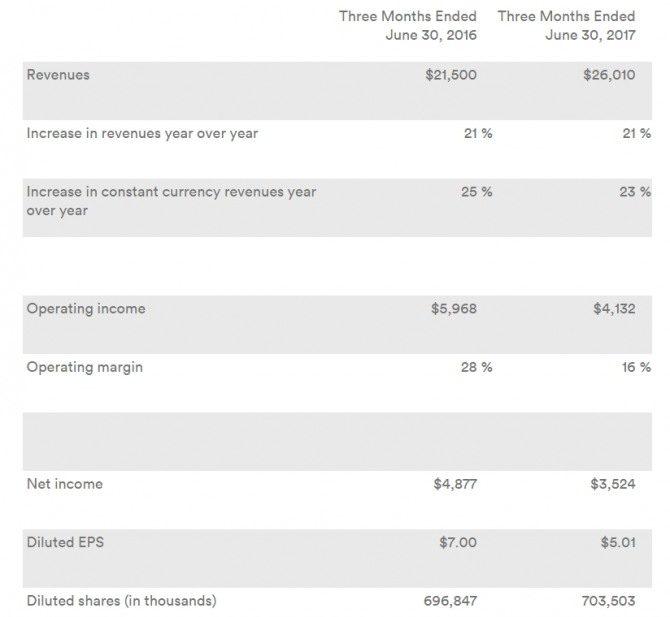

The following summarizes our consolidated financial results for the quarters ended June 30, 2016 and 2017 (in millions, except for per share information, effective tax rate, and headcount; unaudited), reported on a GAAP basis including the impact of the EC fine:

Three Months Ended

June 30, 2016 Three Months Ended

June 30, 2017

Revenues $21,500 $26,010

Increase in revenues year over year 21 % 21 %

Increase in constant currency revenues year over year 25 % 23 %

Operating income $5,968 $4,132

Operating margin 28 % 16 %

Net income $4,877 $3,524

Diluted EPS $7.00 $5.01

Diluted shares (in thousands) 696,847 703,503

Effective tax rate (ETR) 20 % 19 %

Headcount 66,575 75,606

이미지 확대보기

이미지 확대보기Q2 2017 supplemental information

Segment revenues and operating results (in millions; unaudited):

Three Months Ended

June 30, 2016 Three Months Ended

June 30, 2017

Google properties revenues $15,400 $18,425

Google Network Members' properties revenues 3,743 4,247

Google advertising revenues 19,143 22,672

Google other revenues 2,172 3,090

Google segment revenues $21,315 $25,762

Other Bets revenues $185 $248

Google operating income* $6,990 $7,803

Other Bets operating loss $(855) $(772)

*The EC fine is included in reconciling items as it is not allocated to Google for segment reporting purposes.

Traffic acquisition costs (TAC) to Google Network Members and distribution partners (in millions; unaudited):

Three Months Ended

June 30, 2016 Three Months Ended

June 30, 2017

TAC to Google Network Members $2,623 $3,042

TAC to Google Network Members as % of Google Network Members' properties revenues 70 % 72 %

TAC to distribution partners $1,352 $2,049

TAC to distribution partners as % of Google properties revenues 9 % 11 %

Total TAC $3,975 $5,091

Total TAC as % of Google advertising revenues 21 % 22 %

Paid clicks and cost-per-click information (unaudited):

Change from Q2 2016 to Q2 2017 (YoY) Change from Q1 2017 to Q2 2017 (QoQ)

Aggregate paid clicks 52 % 12 %

Paid clicks on Google properties 61 % 15 %

Paid clicks on Google Network Members' properties 9 % (5) %

Aggregate cost-per-click (23) % (6) %

Cost-per-click on Google properties (26) % (8) %

Cost-per-click on Google Network Members' properties (11) % 5 %

The EC fine

On June 27, 2017, the EC announced its decision that certain actions taken by Google regarding its display and ranking of shopping search results and ads infringed European competition law. The EC decision imposes a €2.42 billion (approximately $2.74 billion) fine, which we accrued in the second quarter of 2017. The fine is included in “accrued expense and other current liabilities” on our Consolidated Balance Sheet.

Webcast and conference call information

A live audio webcast of our second quarter 2017 earnings release call will be available at https://abc.xyz/investor. The call begins today at 2:00 PM (PT) / 5:00 PM (ET). This press release, including the reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, is also available on that site.

We also announce investor information, including news and commentary about our business and financial performance, SEC filings, notices of investor events and our press and earnings releases, on our investor relations website.

Forward-looking statements

This press release may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2016, and our most recent Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, which are on file with the SEC and are available on our investor relations website at https://abc.xyz/investor and on the SEC website at www.sec.gov. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2017. All information provided in this release and in the attachments is as of July 24, 2017, and we undertake no duty to update this information unless required by law.

About non-GAAP financial measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: operating income, excluding the EC fine; net income, excluding the EC fine; diluted earnings per share, excluding the EC fine; free cash flow; constant currency revenues; and constant currency revenue growth. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results, such as our revenues excluding the impact for foreign currency fluctuations or our operating performance excluding one-time charges that are infrequent in nature. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management's internal comparisons to our historical performance and liquidity as well as comparisons to our competitors' operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

For more information on these non-GAAP financial measures, please see the tables captioned "Reconciliations of non-GAAP results of operations to the nearest comparable GAAP measures," "Reconciliation from net cash provided by operating activities to free cash flow," and "Reconciliation from GAAP revenues to non-GAAP constant currency revenues" included at the end of this release.

이 같은 실적 발표가 나온 후 구글의 주가는 시간 후 거래에서 폭락세를 보였다.

그러나 유럽연합 벌금을 차감하고도 비교적 양호한 실적을 올린 점 그리고 3분기 이후의 실적 전망이 양호하게 나타나고 있는 점 등이 장기적으로 구글의 주가에 긍전적 영향을 줄 수 있ㅇ을 것으로 보인다.

구글 장 중 주가 추이

Best Bid/Ask N/A / N/A

1 Year Target 1050

Today's High /Low $ 986.20 / $ 970.77

Share Volume 3,248,347

50 Day Avg. Daily Volume 1,656,232

Previous Close $ 972.92

52 Week High/Low $ 988.25 / $ 727.54

Market cap $ 678,148,825,465

P/E Ratio 33.19

Forward P/E(1y)

Earnings Per Share (EPS) $ 29.54

Annualized dividend N/A

Ex Dividend Date N/A

Dividend Payment Date N/A

Current Yield 0 %

Beta 1.5

NASDAQ Official Open Price $ 972.22

Date of Open Price Jul. 24, 2017

NASDAQ Official Close Price $ 980.34

Date of Close Price Jul. 24, 2017

김대호 기자 yoonsk828@g-enews.com