![[분석과 진단] 국제유가 심리적 저항선 이동, WTI 배럴당 60달러까지 … 미국 에너지청 EIA 수요 공급 변동표](https://nimage.g-enews.com/phpwas/restmb_allidxmake.php?idx=5&simg=2017080107474609234906806b77b12114162187.jpg) 이미지 확대보기

이미지 확대보기1일 미국의 뉴욕 상품거래소 NYMEX 에 따르면 미국의 대표 유종인 서부 텍사스산원유 즉 WTI 9월 딜리버리 물은 배럴당 50.1달러에 거래를 마쳤다.

WTI가 50달러 이상으로 오르는 것은 두 달만에 처음이다.

OPEC 를 주도하고 있는 사우디 아라비아의 원유 수출 감소 약속과 미국의 원유 재고 감소 소식이 맞물리면서 원유 선물 사자 분위기가 커졌다.

뉴욕금융시장에서는 국제유가 상승의 심리적 저항선이 상향 이동하고 있다는 분석이 나오고 있다.

그동안에는 배럴당 50달러였으나 앞으로는 배럴당 60달러로 높아질 것이라는 진단이다.

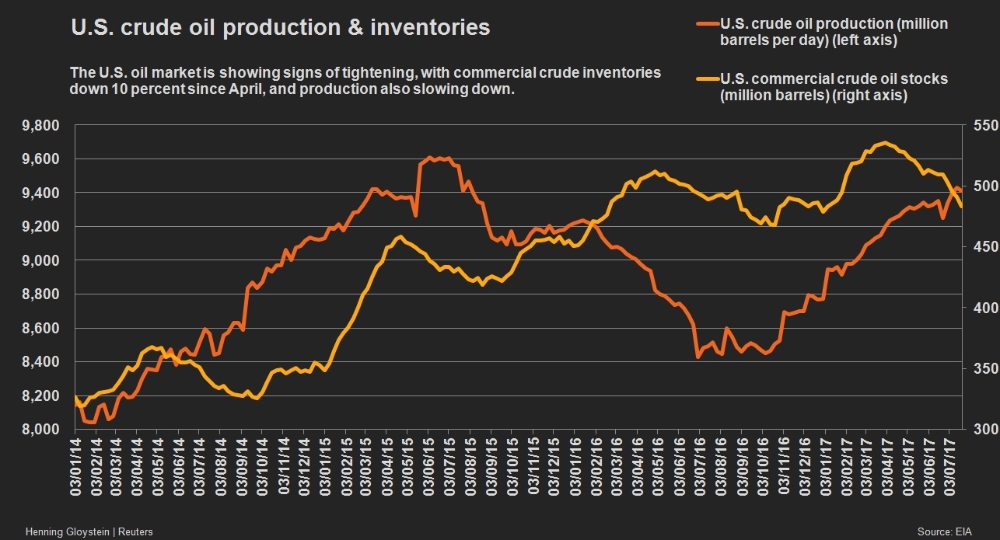

이 같은 분석은 미국 에너지청 EIA 수요 공급 변동표를 분석한 결과이다

NEW YORK (Reuters) - Oil prices rose to two-month highs on Monday, ending the strongest month of the year for crude futures, boosted in part by expectations of U.S. sanctions against Venezuela's oil sector and as supply concerns have waned in recent weeks.

That helped boost prices prior to settlement due to concern about possible limits on oil imports from Venezuela or exports of U.S. fuel to that country. After the close, however, the U.S. Treasury Department announced sanctions limited only to Venezuelan President Nicolas Maduro.

"As far as the oil market is concerned that's a non-event," said James Williams, president of energy consultant WTRG Economics in London, Arkansas. "It's just eye candy as far as I can see."

Benchmark Brent crude LCOc1 rose 0.3 percent to settle at $52.65. Brent earlier hit $52.92 a barrel, its highest since May 25. U.S. light crude oil CLc1 rose nearly 1 percent to settle $50.17 a barrel.

Some OPEC and non-OPEC members will meet on Aug. 7-8 in Abu Dhabi to assess how the group can increase compliance with production cuts that began on Jan. 1.

A Reuters survey on Monday indicated output from OPEC members rose, with June production revised up by 200,000 bpd.

In Europe, a production outage at Royal Dutch Shell Plc's (RDSa.L) 404,000 barrel-per-day Pernis refinery in the Netherlands following a fire sent benchmark European diesel margins to their highest since November 2015 at $14.60 a barrel.

The Brent front-month spread LCOc1-LCOc2 rallied to the strongest in 15 months earlier in the session, ahead of the September contract's expiry. The spread ended back in a contango of 7 cents per barrel, meaning prices were cheaper than the next month.

The strength in Brent prices pushed WTI-Brent spread WTCLc1-LCOc1 to the widest since March 28. The spread settled at a discount of $2.48 a barrel.

(For a graphics on 'U.S. crude oil production, inventories' click reut.rs/2eZsScX)

U.S. crude inventories have fallen by 10 percent from their March peaks to 483.4 million barrels. C-STK-T-EIA

Drilling for new U.S. production is slowing, with just 10 rigs added in July, the fewest since May 2016.

However, U.S. shale production is not rolling over, said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management, who said producers may ramp up production now that oil has rallied.

"I think this rally may be somewhat limited," he said.

로이터 제휴

김재희 기자 yoonsk828@g-enews.com

![[특징주] KRX 2차전지 TOP10지수 6%대 '급락'...하루만에 시총 1...](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=80&h=60&m=1&simg=2025121816155401634edf69f862c11823566245.jpg)