이미지 확대보기

이미지 확대보기29일 새벽에 끝난 뉴욕 증시 나스닥거래소의 28일자 거래에서 트위터의 주가는 43.21달러로 마감했다.

이는 하루 전에 비해 무려 16.36% 떨어진 것이다.

장중 한 때는 낙폭이 18% 선에 이르기도 했다.

1분기 실적발표가 예상보다 크게 밑돌면서 매도물량이 한꺼번에 쏟아진 것.

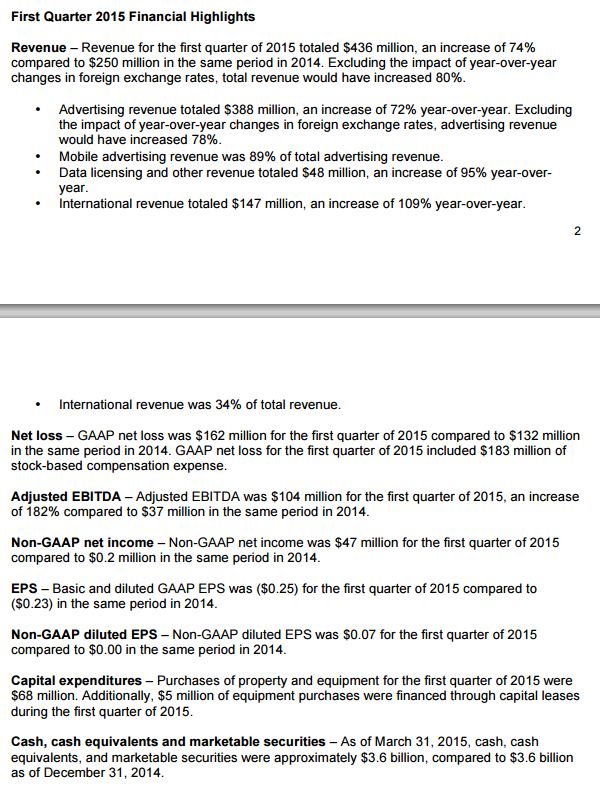

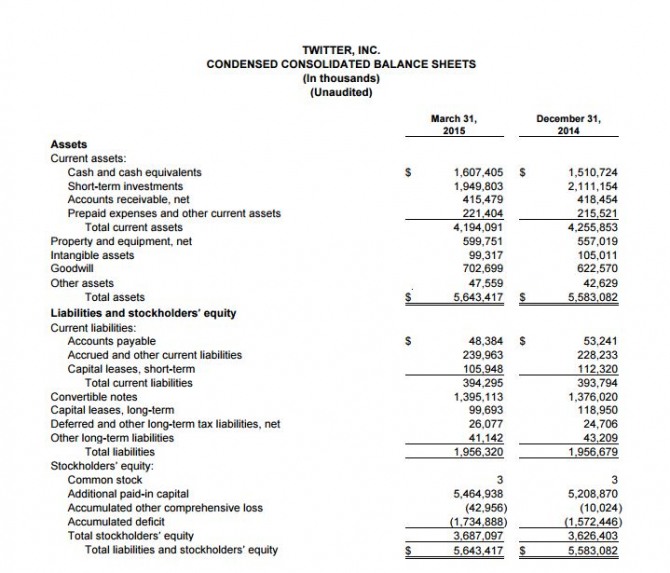

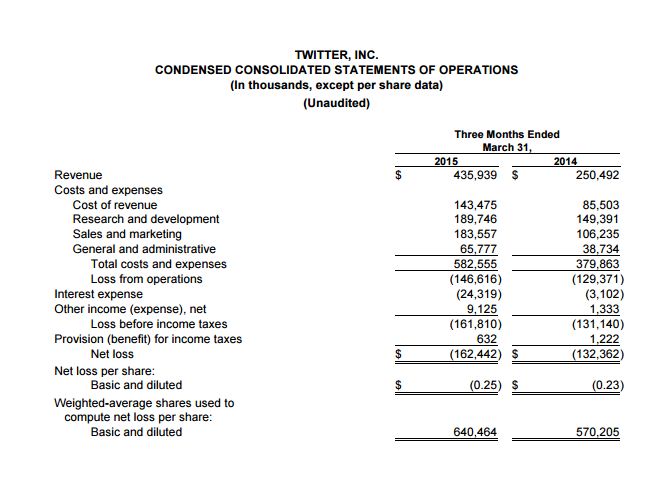

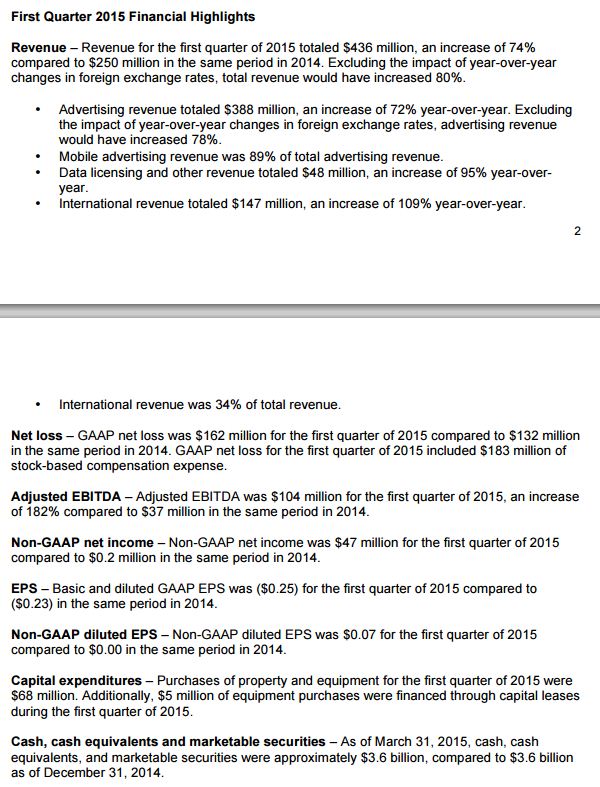

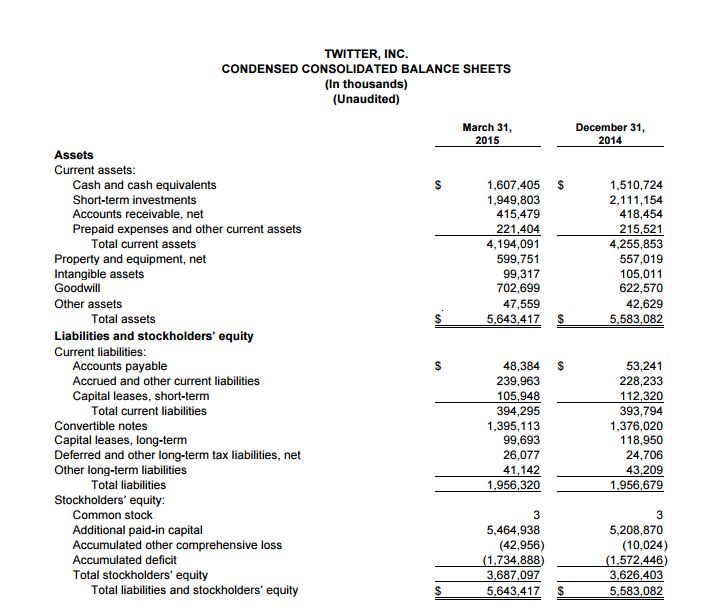

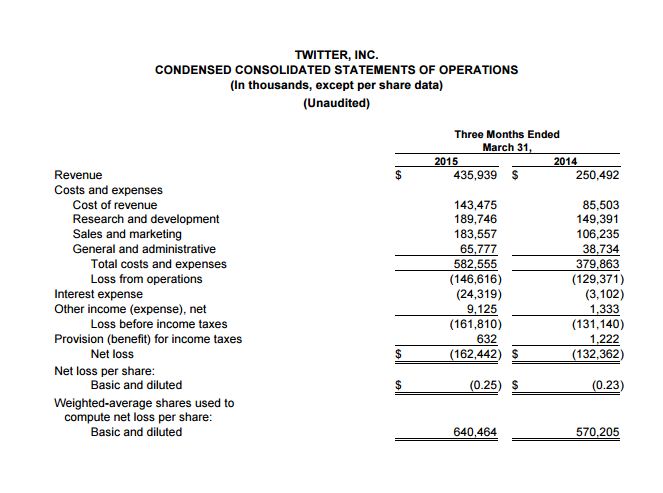

트위터가 발표한 1분기 매출은 전년 동기 대비 74% 증가한 4억3590만 달러였다.

시장의 전망치는 4억5680만 달러였다.

이 기대에 크게 못 미친 것이다.

특히 수지면에서는 1분기에 1억6244만2000 달러의 순손실을 기록했다.

손실규모가 지난해 4분기의 1억3236만 달러에 비해 22.7%나 더 늘었다.

이미지 확대보기

이미지 확대보기이에따라 주당 수익도 0.25달러의 손실을 기록했다.

트위터 이용자 수 증가율 18%도 지난해 4분기의 20%에 비해 2%포인트 하락했다.

이날 트위터의 1분기 실적은 장이 끝난 후 발표할 예정이었으나 주요 내용이 장중에 먼저 새어 나왔다.

<다음은 트위터발 어닝쇼크에 관한 다우존스 보도>

Dow Jones Business News, April 28, 2015, 05:29:00 PM EDT

Twitter Inc. on Tuesday gave downbeat sales guidance for the current quarter and year, as first-quarter revenue rose less than expected, following disappointing results from some of its newer products.

Shares plunged in late-day trading, falling 18% to $42.27, it's second-worst day ever by percentage. The quarterly report--expected after the market close--came out earlier when the website Selerity found the company's earnings release online and began reporting the company's results in tweets.

Twitter Chief Executive Dick Costolo said in the company's news release, "Revenue growth fell slightly short of our expectations due to lower-than-expected contribution from some of our newer direct-response products."

Some of the new products Twitter has introduced include video functionality, the "while you away" recap feature, instant timelines and group direct messaging.

이미지 확대보기

이미지 확대보기The San Francisco-based company is under intense scrutiny as Mr. Costolo and his new leadership team tries to show investors that they still have ways to reinvigorate user growth and generate the kind of revenue that matches the powerful platform's cultural influence.

In the latest quarter, the number of Twitter users who log in at least once a month rose to 302 million in the March quarter, up 18% from the prior-year period.

For the current second quarter, the company expects revenue between $470 million to $485 million, below analyst estimates of $538 million. For the full year, the company expects sales of $2.17 billion to $2.27 billion, again below analyst estimates of $2.37 billion.

Separately, the company said that it has agreed to acquire marketing company TellApart Inc. and will partner with Google's DoubleClick advertising platform. Financial terms of the TellApart deal, which is expected to close around June 1, weren't disclosed.

Twitter has yet to eke out a profit amid ongoing investments on new data centers, office expansion and talent.

For the latest quarter, Twitter reported a loss of $162 million, or 25 cents a share, compared with a loss of $132 million, or 23 cents a share a year earlier. Excluding stock-based compensation and other items, the company's per-share earnings rose to seven cents a share from zero cents a share in the prior-year period.

Analysts, on average, were expecting earnings of four cents a share, according to Thomson Reuters.

Revenue increased 74% to $435.9 million. The company had expected earnings between $440 million to $450 million, while analysts surveyed by Thomson Reuters estimated, on average, that Twitter would post revenue of $456.8 million.

Advertising revenue grew 72% to $388 million, with mobile advertising revenue comprising 89% of the amount. International revenue more than doubled to $147 million.

The San Francisco company's maturing advertising business, which comprises the bulk of its revenue, is making further headway, riding the wave of advertising dollars shifting to mobile and social platforms.

Less than an hour before the market's close, Selerity--a New Jersey firm that crawls the Web for financial data-- began reporting Twitter's earnings numbers in multiple tweets. The firm says its Web-crawling software found the link to Twitter's news release announcing the earnings on the company's publicly available investor relations page.

"There is occasional scraping that occurs," said Brendan Gilmartin, Selerity's executive vice president of content and client services, in an interview. "In this instance, we noticed that the results were available."

It wasn't clear when Twitter may have first inadvertently published the link and if it removed it once Selerity started tweeting the results. Twitter has said it is investigating the leak.

이미지 확대보기

이미지 확대보기김대호 연구소 소장/ 경제학 박사 tiger8280@

[알림] 본 기사는 투자판단의 참고용이며, 이를 근거로 한 투자손실에 대한 책임은 없습니다.

![[뉴욕증시] S&P500·나스닥, 사상 최고치](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=270&h=173&m=1&simg=2025070106534103619c35228d2f5175193150103.jpg)