![[국제유가] WTI 마침내 50달러 뉴욕증시 코스피 청신호… 트럼프 북한문제 해결될 것 호언장담](https://nimage.g-enews.com/phpwas/restmb_allidxmake.php?idx=5&simg=2017080103373300494906806b77b12114162187.jpg) 이미지 확대보기

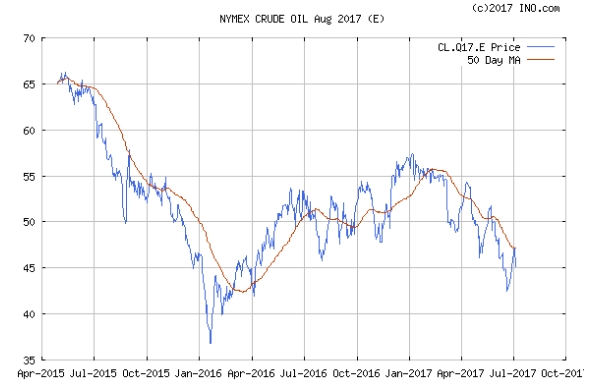

이미지 확대보기1일 뉴욕 상업거래소에 따르면 미국의 대표 유종인 서부텍사스산 WTI Crude Oil 원유는 Nymex 에서 이 시각 현재 USD/bbl당 49.81달러릴 지나고 있다.

전일대비 0.10 달러, 비율로는 0.20 % 오른 것이다.

이런 추세라면 WTI눈 50달러 선에 안착할 것으로 보인다.

전일대비 0.05달러 비율로는 0.10%오른 것이다.

국제유가가 이처럼 오르느 것은 OPEC 국가들이 감산을위해 또 회동한다는 소식에다 산유국 베네수엘라에 국제적 제제 논의가 영향을 미친 것으로 보고 있다.

크럼프 아베 전화 통화 이후 북한에 대한 군사대응 분위기도 국제유가 상승에 한 요인이 되고 있다.

트럼프 북한문제 해결될 것이라는 호언장담이 군사적 행동으로 해석되고 있는분위기이다.

WTI Crude Oil (Nymex) USD/bbl. 49.81 +0.10 +0.20% Sep 2017 2:12 PM

Brent Crude (ICE) USD/bbl. 52.57 +0.05 +0.10% Sep 2017 2:12 PM

RBOB Gasoline (Nymex) USd/gal. 170.55 +2.94 +1.75% Aug 2017 2:12 PM

Natural Gas (Nymex) USD/MMBtu 2.79 -0.15 -5.24% Sep 2017 2:12 PM

Heating Oil (Nymex) USd/gal. 165.17 +1.20 +0.73% Aug 2017 2:11 PM

다음은 국제유가에 대한 로이터 통신의 보도 Oil prices were near two-month highs on Monday, putting July on track to become the strongest month so far this year, as news of a producers' meeting next week added to bullish sentiment driven by the threat of U.S. sanctions against OPEC-member Venezuela.

Benchmark Brent crude LCOc1 traded down 19 cents or .36 percent at $52.33 a barrel at 12:00 p.m. (1600 GMT). Brent earlier hit $52.92 a barrel, its highest since May 25.

U.S. light crude oil CLc1 traded down 40 cents or .8 percent at $49.31 a barrel.

U.S. crude had jumped above $50 a barrel for the first time in two months early in the session, after U.S. officials said sanctions on Venezuela could be announced as early as Monday.

The United States is considering imposing sanctions on the country's oil sector in response to Sunday's election of a constitutional super-body, which Washington has denounced as a "sham" vote.

Even though the White House has said that "all options are on the table," the most likely action, banning Venezuela from importing U.S. oil, could come as early as Monday.

A Reuters survey on Monday indicated output from OPEC members rose, mostly from adjustments upward to Iraqi and Saudi output.

"The upward revision by 200,000 in June for OPEC-13 is quite shocking," said Commerzbank senior oil analyst Carsten Fritsch, "Compliance already slipped sharply in June to 77% (initially reported at 92%)."

However some OPEC and non-OPEC members will meet on Aug. 7-8 in Abu Dhabi to assess how the group can increase compliance with production cuts that began on Jan. 1.

Hedge funds and money managers have raised bullish bets on U.S. crude oil to their highest in three months, U.S. data showed.

In Europe, a production outage at Shell's 404,000 barrel-per-day Pernis refinery in the Netherlands following a fire sent benchmark European diesel margins, which reflect the profit made from refining crude oil into the road fuel, to their highest since November 2015 at $14.60 a barrel.

U.S. production has hampered efforts to rebalance the market but signs the market is tightening have emerged after heavy inventory falls and slower new oil rig additions last week.

U.S. crude inventories have fallen by 10 percent from their March peaks to 483.4 million barrels. C-STK-T-EIA

U.S. output dipped by 0.2 percent to 9.41 million barrels per day (bpd) in the week to July 21, after rising by more than 10 percent since mid-2016. C-OUT-T-EIA

Drilling for new U.S. production is also slowing, with just 10 rigs added in July, the fewest since May 2016.

[로이터 제휴]

김재희 기자 yoonsk828@g-enews.com