벤 버냉키 전 FRB의장까지 영입했지만 역부족

이미지 확대보기

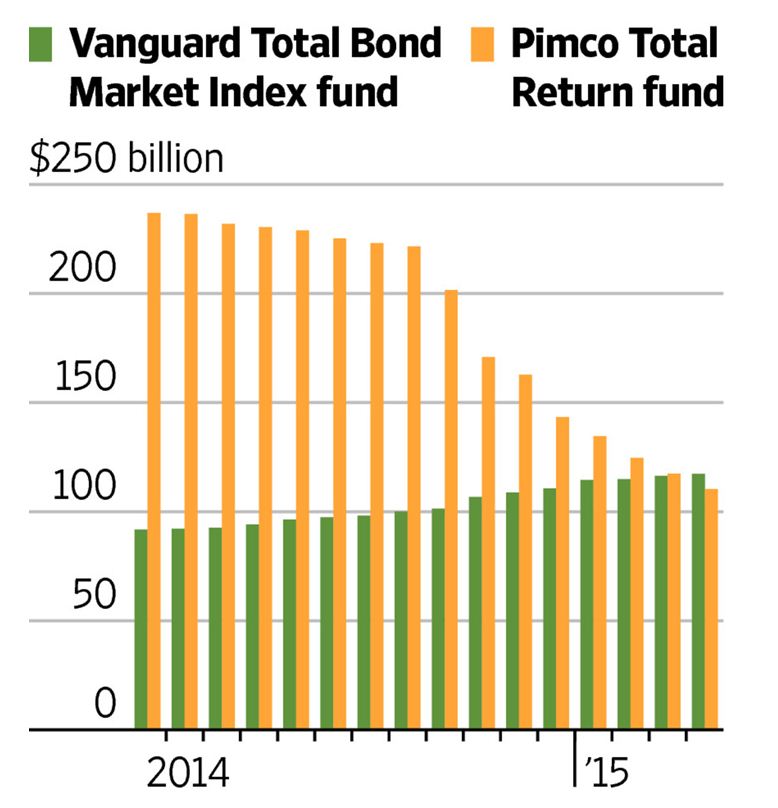

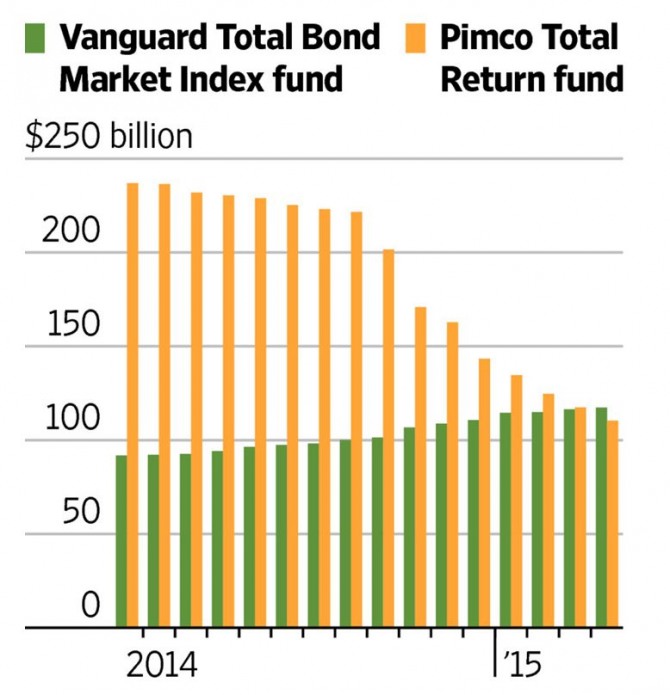

이미지 확대보기월스트리트저널(WSJ)은 4일 (현지시간) 온라인과 신문에 올린 기사에서 미국의 자산운용사 뱅가드 그룹의 간판펀드인 '뱅가드토털본드마켓인덱스펀드'가 그동안 부동의 1위로 군림해왔던 핌코의 간판펀드인 ‘토탈리턴펀드’를 앞서며 자산운용 규모에서 세계 선두로 올라섰다고 보도했다.

/월스트리트 기사전문 별첨

이 보도에 따르면 뱅가드 그룹이 운영하는 뱅가드토털본드마켓인덱스펀드의 운용자산 규모는 1173억 달러에 달했다.

반면 핌코의 '토탈리턴펀드'는 1104억 달러로 줄어들었다.

핌코의 '토털리턴펀드‘에서는 최근 환매가 크게 늘었다.

토털리턴펀드가 세계 최대의 펀드 자리에서 쫓겨난 것은 17년 만이다.

핌코의 토털리턴펀드는 '채권왕'으로 불리는 빌 그로스가 야누스캐피털로 자리를 옮긴 이후 계속 위축되어왔다.

미국 연방준비제도 이사회(FRB)의 의장을 역임한 벤 버냉키까지 영입했지만 이탈하는 고객을 막기에는 아직 역부족이다.

떠난 빌 그로스의 저주가 현실화되고 있는 것.

이미지 확대보기

이미지 확대보기[다음은 자산운용사 뱅가드 그룹의 간판펀드인 '뱅가드토털본드마켓인덱스펀드'의 1위 등극을 알리는 월스크리트 저널의 보도전문]

For almost two decades, Pacific Investment Management Co. has laid claim to the world’s largest bond fund.

On Monday, it lost that title to Vanguard Group, whose Total Bond Market Index fund ended April with $117.3 billion in assets under management, surpassing the Pimco Total Return fund, which closed the month with $110.4 billion, according to estimates from both companies.

A year ago, the two funds were more than $100 billion apart, demonstrating the remarkable turnabout in fortunes at Pimco in recent years that began with sagging performance of the fund and culminated in the striking departure of its star manager and co-founder Bill Gross.

Meet the New Bond King (March 17)Bill Gross Leaves Pimco for Janus (Sept. 26).The toppling of Total Return marks a significant turning point for the industry as investors flock to plain-vanilla funds that follow market indexes rather than relying on star managers to pick winners.

Malvern, Pa.-based Vanguard, known for its hands-off approach to investing, won an unprecedented race among asset managers for investor money sparked when Mr. Gross left Pimco in September.

Pimco Total Return first became the industry’s largest by assets in 1997 and at its peak in April 2013 had $293 billion in assets under management. It was the flagship of a company that became a behemoth overseeing almost $2 trillion in assets. The company’s complex, located about a mile from the Pacific Ocean, was called “the Beach” on Wall Street trading desks.

But Pimco’s grip weakened as Mr. Gross’s returns began to suffer in 2014 and outflows increased. He left Pimco after clashes with Pimco executives and increasingly erratic behavior. He now runs a smaller mutual fund at rival Janus Capital Group Inc. and declined comment through a spokeswoman.

Another blow for Pimco was a trend away from fund managers such as Mr. Gross and toward so-called passive investments that mimic indexes and other benchmarks for a fraction of the cost of the typical mutual fund.

“The indexing story helps,” said Joshua Barrickman, senior portfolio manager of Vanguard’s Total Bond Market Index fund, which tracks a version of the Barclays U.S. Aggregate Bond Index. “It continues to have a lot of momentum and people are starting to see that it makes sense.”

A Pimco spokeswoman declined to comment. Pimco, with about $1.6 trillion under management, is based in Newport Beach, Calif. and is a unit of German insurer Allianz SE.

Vanguard’s ascension is significant, say analysts and industry observers, because the Pimco Total Return fund has for so long dominated the world of mom-and-pop fixed-income investing as Mr. Gross presided over its massive growth and helped to make it a household name.

“There’s no guarantee of staying on top forever,” said Jeff Tjornehoj, head of Americas research for mutual-fund-research firm Lipper. “It’s shocked a lot of people how quickly things changed at Pimco from the company that seemed to have very few setbacks to finding themselves over the last year and a half struggling to overcome them.”

The Pimco fund is more expensive but has seen higher returns than the Vanguard fund, which is tasked with tracking the index.

So far this year through Friday, the Pimco Total Return fund has returned 1.36%, compared with 0.91% for the Barclays U.S. Aggregate Bond Index, while the Vanguard fund has returned 0.94%, according to Morningstar. The Pimco’s fund average annual return over three years through Friday is 3.24%, compared with 2.54% for the index. Vanguard’s fund returned 2.44% over that time.

The Vanguard Total Bond Market Index fund’s largest share class has an expense ratio of 0.07%, or $7 for every $10,000 invested, compared with 0.46%, or $46 for every $10,000 invested in the Pimco Total Return fund’s largest share class, according to Morningstar.

Investors pulled about $103 billion from the Pimco Total Return fund last year, the bulk of it after Mr. Gross left, according to Morningstar and Pimco. The loss of an additional $5.6 billion in April was the 24th consecutive month of withdrawals.

As money managers scrambled for billions leaving the firm, the Vanguard Total Bond Market Index fund became one of the biggest recipients of that cash, Vanguard says.

Mr. Barrickman’s fund saw about $15 billion in investor inflows last year and has seen its assets increase from $110.6 billion at the end of 2014 to $117.3 billion in April.

Mr. Barrickman, who is also head of fixed-income investing Americas, has nabbed investors without increasing marketing or relying on tough sales pitches. In an interview Monday, he said the interest from investors is just an affirmation of Vanguard’s low cost-model. Actively managed funds often come with higher fees.

“Assets show up and that’s great, because it’s verifying what we’re doing is valuable,” he said.

Surpassing Pimco as manager of the largest bond fund marks a banner year for Vanguard, which also runs the biggest stock fund and set a mutual-fund-industry record in 2014 for the highest amount of annual investor inflows. The firm also hit $3 trillion in assets under management last year.

Pimco has been scrambling to keep clients following its tumultuous 2014 but in early December one of three new Total Return managers said the firm had moved past the knee-jerk reaction in terms of flows that you would expect to happen.

Outflows slowed each month this year, down from last year when investors pulled as much as $8 billion on one day in October. The slowdown in withdrawals has coincided with strong performance compared with rivals.

이미지 확대보기

이미지 확대보기김대호 연구소 소장 tiger8280@