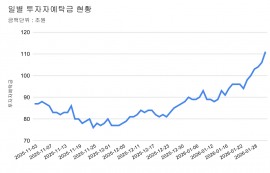

실업률

이미지 확대보기

이미지 확대보기8일 뉴욕증시에 따르면 미국 노동부는 2월 고용보고서를 발표했다.이 고용보고서에 따르면 미국의 2월 신규고용은 27만 5000명 늘어났다. 1월보다는 적지만 시장 예측치 보다는 훨씬 많다. 실업률은 3.9%로 기존의 3.7%보다 높아졌다.

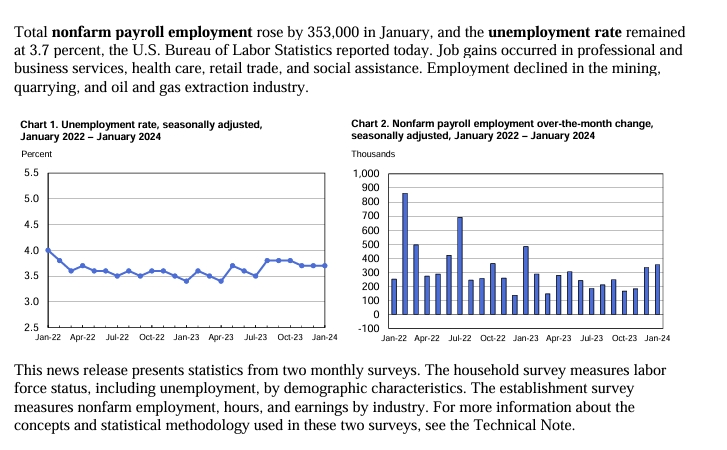

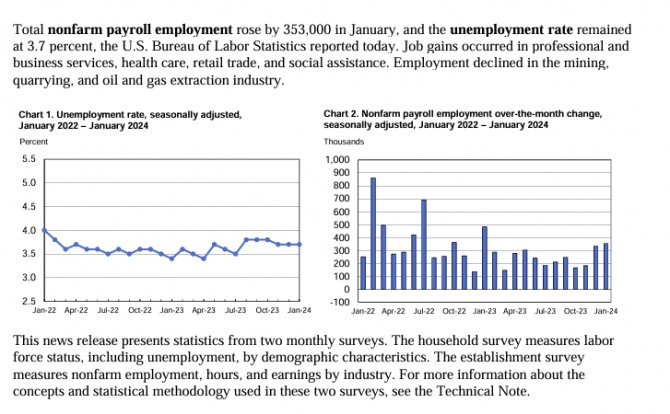

Employment Situation Summary

THE EMPLOYMENT SITUATION -- FEBRUARY 2024

increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains

occurred in health care, in government, in food services and drinking places, in social

assistance, and in transportation and warehousing.

This news release presents statistics from two monthly surveys. The household survey

The establishment survey measures nonfarm employment, hours, and earnings by industry.

For more information about the concepts and statistical methodology used in these two

surveys, see the Technical Note.

Household Survey Data

The unemployment rate rose by 0.2 percentage point to 3.9 percent in February, and the

number of unemployed people increased by 334,000 to 6.5 million. A year earlier, the

jobless rate was 3.6 percent, and the number of unemployed people was 6.0 million. (See

table A-1.)

Among the major worker groups, the unemployment rates for adult women (3.5 percent) and

teenagers (12.5 percent) increased over the month. The jobless rates for adult men (3.5

percent), Whites (3.4 percent), Blacks (5.6 percent), Asians (3.4 percent), and

Hispanics (5.0 percent) showed little or no change in February. (See tables A-1, A-2,

and A-3.)

Among the unemployed, the number of permanent job losers increased by 174,000 to 1.7

million in February. The number of people on temporary layoff was little changed at

827,000. (See table A-11.)

The number of long-term unemployed (those jobless for 27 weeks or more), at 1.2 million,

was little changed in February. The long-term unemployed accounted for 18.7 percent of

all unemployed people. (See table A-12.)

In February, the labor force participation rate was 62.5 percent for the third consecutive

month, and the employment-population ratio was little changed at 60.1 percent. These

measures showed little or no change over the year. (See table A-1.)

The number of people employed part time for economic reasons, at 4.4 million, changed

little in February. These individuals, who would have preferred full-time employment,

were working part time because their hours had been reduced or they were unable to find

full-time jobs. (See table A-8.)

In February, the number of people not in the labor force who currently want a job, at

5.7 million, was little changed. These individuals were not counted as unemployed because

they were not actively looking for work during the 4 weeks preceding the survey or were

unavailable to take a job. (See table A-1.)

Among those not in the labor force who wanted a job, the number of people marginally

attached to the labor force changed little at 1.6 million in February. These individuals

wanted and were available for work and had looked for a job sometime in the prior 12

months but had not looked for work in the 4 weeks preceding the survey. The number of

discouraged workers, a subset of the marginally attached who believed that no jobs were

available for them, was little changed at 425,000 in February. (See Summary table A.)

Establishment Survey Data

Total nonfarm payroll employment rose by 275,000 in February, above the average monthly

gain of 230,000 over the prior 12 months. In February, job gains occurred in health care,

in government, in food services and drinking places, in social assistance, and in

transportation and warehousing. (See table B-1.)

Health care added 67,000 jobs in February, above the average monthly gain of 58,000 over

the prior 12 months. In February, job growth continued in ambulatory health care

services (+28,000), hospitals (+28,000), and nursing and residential care facilities

(+11,000).

Government employment rose by 52,000 in February, about the same as the prior 12-month

average gain (+53,000). Over the month, employment continued to trend up in local

government, excluding education (+26,000) and federal government (+9,000).

Employment in food services and drinking places increased by 42,000 in February, after

changing little over the prior 3 months.

Social assistance added 24,000 jobs in February, about the same as the prior 12-month

average gain of 23,000. Over the month, job growth continued in individual and family

services (+19,000).

Employment in transportation and warehousing rose by 20,000 in February. Couriers and

messengers added 17,000 jobs, after losing 70,000 jobs over the prior 3 months. In

February, job growth also occurred in air transportation (+4,000), while warehousing

and storage lost 7,000 jobs. Employment in the transportation and warehousing industry

is down by 144,000 since reaching a peak in July 2022.

In February, employment continued to trend up in construction (+23,000), in line with

the average monthly gain of 18,000 over the prior 12 months. Over the month, heavy

and civil engineering construction added 13,000 jobs.

Retail trade employment changed little in February (+19,000) and has shown little net

change over the year. Over the month, job gains in general merchandise retailers

(+17,000); health and personal care retailers (+6,000); and automotive parts,

accessories, and tire retailers (+5,000) were partially offset by job losses in

building material and garden equipment and supplies dealers (-6,000) and electronics

and appliance retailers (-2,000).

Employment showed little change over the month in other major industries, including

mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade;

information; financial activities; professional and business services; and other

services.

In February, average hourly earnings for all employees on private nonfarm payrolls

edged up by 5 cents to $34.57, following an increase of 18 cents in January. Average

hourly earnings were up by 0.1 percent in February and 4.3 percent over the year.

In February, average hourly earnings of private-sector production and nonsupervisory

employees edged up by 7 cents, or 0.2 percent, to $29.71. (See tables B-3 and B-8.)

In February, the average workweek for all employees on private nonfarm payrolls

edged up by 0.1 hour to 34.3 hours, following a decline of 0.2 hour in January. In

manufacturing, the average workweek was little changed at 39.9 hours, and overtime

increased by 0.2 hour to 3.0 hours in February. The average workweek for production

and nonsupervisory employees on private nonfarm payrolls increased by 0.3 hour to

33.8 hours, following a decline of 0.3 hour in January. (See tables B-2 and B-7.)

The change in total nonfarm payroll employment for December was revised down by

43,000, from +333,000 to +290,000, and the change for January was revised down by

124,000, from +353,000 to +229,000. With these revisions, employment in December

and January combined is 167,000 lower than previously reported. (Monthly revisions

result from additional reports received from businesses and government agencies

since the last published estimates and from the recalculation of seasonal factors.)

미국 뉴욕증시에서는 발표에 앞서 2월 비농업 고용이 19만8천명 증가해 전달의 35만3천명 증가보다 둔화할 것으로 예상한 바 있다. 실업률은 3.7%로 그 전인 1월과 같은 수준을 보일 것으로 예상했다. 미국 노동부는 앞서 신규 실업수당 청구 건수가 한 주 전과 같은 수준인 21만7천건으로 집계됐다고 밝혔다. 이는 뉴욕증시 전문가 전망치에 부합하는 것이다. 신규 실업수당 청구 건수는 지난해 7월 이후 감소세를 보이다가 작년 9월 중순 이후 20만건대 언저리에서 등락을 거듭하고 있다.

최소 2주 이상 실업수당을 신청하는 '계속 실업수당' 청구 건수는 2월 18∼24일 주간 190만6천건으로 한 주 전보다 8천건 증가, 지난해 11월 18∼24일 주간(192만5천건) 이후 3개월 만에 가장 높았다. 이는 기존 실직자 중 일자리를 새로 구한 이들이 줄었음을 시사한다. 미 연방준비제도(Fed·연준)는 노동시장 과열이 인플레이션 고착화를 초래할 수 있다고 보고 고용 관련 지표를 눈여겨보고 있다.

민간 고용은 예상보다 부진했다. ADP 전미 고용보고서에 따르면 2월 민간 부문 고용은 전월보다 14만명 증가한 것으로 집계됐다. 이는 월스트리트저널(WSJ)이 집계한 전문가 예상치 15만명 증가를 밑도는 수준이다. 지난 1월 기록한 11만1천명에 이어 10만명대 수준을 유지했다. 2월 임금은 지난해 같은 기간보다 5.1% 올라 2021년 8월 이후 가장 낮은 수준을 보였다. 시장 참가자들은 8일에 나올 노동부의 비농업 고용 지표를 앞두고 고용 시장이 둔화하고 있다는 데 안도했다.

뉴욕증시는 제롬 파월 연방준비제도(연준·Fed) 의장의 발언에 이틀째 상승했다. S&P500지수는 기술주와 성장주의 상승에 힘입어 사상 최고치로 마감했다. 뉴욕증권거래소(NYSE)에서 다우존스30산업평균지수는 전장보다 130.30포인트(0.34%) 오른 38,791.35로 거래를 마쳤다. 스탠더드앤드푸어스(S&P)500지수는 전장보다 52.60포인트(1.03%) 상승한 5,157.36으로, 나스닥지수는 전장보다 241.83포인트(1.51%) 뛴 16,273.38로 장을 마감했다. S&P500지수는 마감가 기준 최고치를 경신했고, 나스닥지수는 장중 최고치를 갈아치웠다. 나스닥지수는 마감가 기준으로는 이달 1일 기록한 직전 최고치에 근접했다.

김대호 글로벌이코노믹 연구소장 tiger8280@g-enews.com