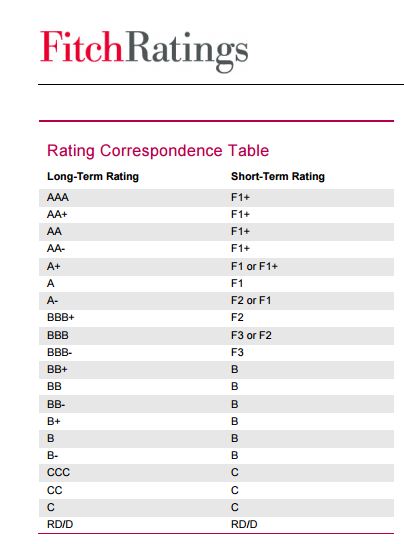

‘AAA’과 'F1+'는 20단계로 되어있는 피치의 신용등급 체계에서 가장 높은 수준이다.

또 미국 경제의 다양성과 첨단기술의 강세 그리고 양호한 비즈니스 환경 등도 강점으로 꼽았다.

그동안 미국의 큰 골칫거리였던 재정적자 또한 한 고비를 넘어섰다는 것이 피치의 분석이다.

이어 지난 2014년 국내총생산(GDP)의 100%까지 치솟았던 정부 부채도 2015년부터는 크게 개선될 것으로 내다봤다.

피치는 이밖에도 미국의 신용등급 전망도 '안정적'으로 판정했다. 여기서의 '안정적'이란 상당기간 현수준을 유지한다는 것으로 특별한 돌발 변수가 없는 한 미국의 신용등급이 최고 수준에서 떨어지지 않는다는 의미이다.

미국에 대한 피치의 최우수 신용등급 부여는 미국이 2008년 '리먼 브러더스' 사태로 야기된 글로벌 금융위기에서 완전히 벗어났음을 보여준다.

이 회사는 1913년 존 놀스(John Knowles)가 미국 뉴욕에서 피치 퍼블리싱 컴퍼니(Fitch Publishing Company)라는 이름으로 창업했다.

다음은 미국의 신용등급을 장기 'AAA', 단기는 'F1+'로 평가한 배경에 관한 피치의 공식 발표 전문.

[피치발표문 전문]

Fitch Ratings has affirmed the United States' Long-term foreign and local currency Issuer Default Ratings (IDRs) at 'AAA'. Fitch has also affirmed the issue ratings on the United States' senior unsecured foreign and local currency bonds at 'AAA'. The Rating Outlooks on the Long-term IDRs are Stable. Fitch affirms the Country Ceiling at 'AAA' and the Short-term foreign currency IDR at 'F1+'.

The U.S.'s 'AAA' rating is underpinned by the sovereign's unparalleled financing flexibility as the issuer of the world's pre-eminent reserve currency and benchmark fixed-income asset, and as home to the world's deepest and most liquid capital markets.

The federal government deficit is expected to narrow further in 2015 and 2016 from the 2.8% of GDP recorded in 2014. The medium-term deficit outlook has improved slightly on a combination of economic strength and lower than expected interest rates. Healthcare cost inflation has also slowed. However, without reforms to mandatory spending and/or taxation, the deficit will rise again from 2018.

Congress and the White House have set out differing budget proposals for FY16. Republicans in Congress propose to eliminate the deficit over the next decade, while the President's budget sets out a much milder consolidation. Fitch expects little progress on reforms proposed in either the congressional or President's budgets, despite cross-party consensus on topics such as the desirability of corporate tax reform. The U.S. has achieved a rapid fiscal consolidation based on economic recovery and tight spending limits, but further deficit narrowing will be more hard-won.

Fitch expects general government debt to start trending down in 2015 from a peak of 100% of GDP in 2014. Under the agency's projections, which assume no policy change and a normalisation of interest rates, it will start to tick up again from 2019. This is in line with Fitch's September projections. Fitch excludes unfunded pension liabilities and trade payables from its definition of general government debt. Federal debt held by the public was 73% of GDP in December 2014.

The ceiling on federal debt was re-imposed on March 16. Until Congress votes to lift the ceiling, the federal government is prevented from increasing the stock of debt and can only roll over existing debts falling due. The government can use extraordinary measures to meet obligations without incurring new debt until around October 2015. Fitch believes that Congress will lift the debt ceiling before this so-called 'x date', albeit perhaps close to it.

Notwithstanding brinkmanship over the debt ceiling in Congress on previous occasions, most recently in October 2013, the attraction of U.S. Treasuries as a reserve asset appears undiminished. Foreign holdings of Treasury securities have increased by 10%, or USD560 billion, since October 2013.

The U.S. is growing faster and enjoys better growth prospects than most of the developed world. Having expanded 2.4% in 2014, Fitch expects the U.S. to grow 3% in 2015, decelerating slightly in 2016. Since mid-2014, a strengthening dollar has undercut export performance, while a steep fall in oil prices has increased disposable income. Job creation has been rapid and should lead to rises in real wages, which have been weak so far in this recovery. Fitch expects the economy to withstand a gradual tightening of monetary policy from very loose settings.

At its March 2015 meeting, the Fed signalled it would tighten monetary policy gradually, implying a shallower path for interest rate rises than previously expected. Fitch expects the Fed to embark on tightening in 3Q15. The annual inflation rate is zero, a transitory result of lower fuel prices and the strong dollar. Inflation is likely to remain below the 2% inflation target in 2016.

The economy is large, rich and diverse, with GDP per capita (at purchasing power parity) and levels of human development above the 'AAA' median. The economy is one of the most productive, dynamic and technologically advanced in the world, underpinned by strong institutions and a favourable business climate.

The current Rating Outlook is Stable. Consequently, Fitch's sensitivity analysis does not currently anticipate developments with a material likelihood, individually or collectively, of leading to a downgrade. However, future developments that may, individually or collectively, lead to negative rating action include:

A significant increase in government deficits and debt/GDP ratio, for example if the U.S. authorities do not take measures in the medium to long term to offset rising expenditure pressures from aging and higher interest rates, could lead to a downgrade.

A deterioration in the coherence and credibility of economic policymaking or a negative shock that erodes the role of the U.S. dollar as the pre-eminent global reserve currency and reduces financing flexibility and debt tolerance could lead to a downgrade.

Fitch assumes that the federal debt limit, which was re-imposed on March 16, 2015, will be suspended again or raised in due course before the Treasury exhausts its extraordinary measures and capacity to fund the government.

Fitch's medium-term fiscal projections draw heavily upon Congressional Budget Office projections, which incorporate a baseline assumption that current laws governing federal taxes and spending generally remain the same. Fitch's projections also assume that the medium-term growth potential of the U.S. economy is just above 2%. Its projections are sensitive to these and other economic and fiscal assumptions.

Financial sector risks are currently judged to be low, as reflected in Fitch's stable outlook for the U.S. banking sector and Bank Systemic Indicator of 'a'.

김대호 경제연구소 소장 tiger8280@

![[초점] 퇴보하는 ‘이민자의 나라’…美 반이민 정서 확산](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=184&h=118&m=1&simg=20240426105827034139a1f3094311109215171.jpg)

![[속보] 美 3월 근원 PCE 물가, 전년比 2.8% 증가...시장 예상치 ...](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=80&h=60&m=1&simg=20240426212148010594a01bf698f12113517828.jpg)