이미지 확대보기

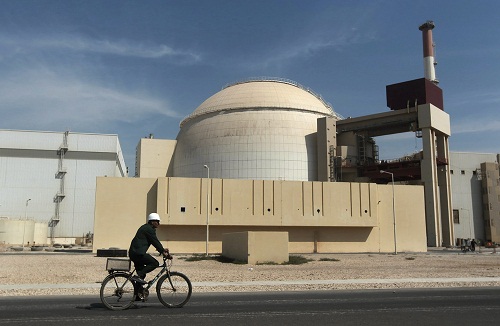

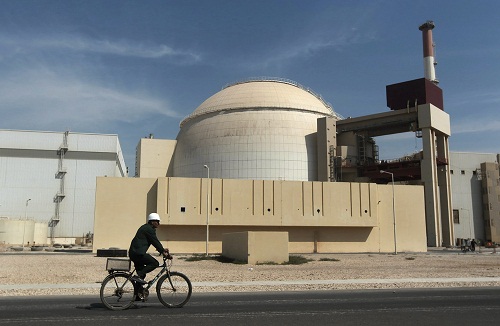

이미지 확대보기주인공은 중국핵에너지전력(CNNP)이다.

줄여서 ‘중국핵전’이라고도 부른다.

우리나라의 한국수력원자력 즉 ‘한수원’과 유사한 기업이다.

사실상 민영화를 단행하는 것이다.

이에 따라 중국핵전은 곧 증시에서 IPO를 하면서 신주매각을 통해 16억 위안을 조달할 계획이다.

미국 달러 기준 26억 달러에 달하는 자금을 조달하게 된다.

우리 돈으로 약 3조원에 달하는 거액이다.

2010년 8월 중국 에버브라이트은행이 증시에서 26억 달러를 조달한 이후 5년여 만에 최대 규모의 IPO다.

중국핵전은 증시에서 조달한 자금을 핵발전소 건립 등에 사용할 계획이다.

중국은 2020년까지 핵 발전량을 현재의 두 배이상인 58 기가와트(GW)까지 끌어올린다는 방침이다.

다음은 중국 영문경제뉴스인 ECNS의 보도내용 전문

China National Nuclear Power Co, one of the country's three State-owned nuclear power developers, is a step closer to raising more than 16 billion yuan ($2.6 billion) in an initial public offering.

Plan by the nuclear power company, a subsidiary of China National Nuclear Corp, to sell up to 3.65 billion shares was approved on Wednesday by the China Securities Regulatory Commission, the country's securities regulatory body.

About 9.2 billion yuan of the funds will be used in building and operating 10 coastal nuclear power stations in Jiangsu, Zhejiang, Fujian and Hainan provinces, with the rest used as working capital as it expands, said officials.

The company first filed its IPO application to the securities authorities in 2012, but the request was shelved as China tightened its grip on large-cap stock flotations worth over 5 billion yuan.

Experts said the long-awaited public offering of shares in a nuclear-focused company has generated a lot of interest, but investors are also being advised to be cautious about the issue, which is expected to become the largest A-share floatation in four years.

Li Daxiao, chief economist at Yingda Securities Co Ltd, said that an upcoming wave of listings is likely to have a negative impact on the market, and that current valuations have not factored in this "IPO effect".

Li said that it seems investors are not fully prepared for what could become a huge amount of new shares flooding the market, as the country pushes toward a registration-based system for new offerings, which will no longer require government approval.

"Given the current market frenzy, prices of new shares could soar on the day they debut. But the risk is also growing that the valuations of some companies have risen too high," he said.

Conventional market wisdom is that a wave of IPOs, especially of large-caps, would cause a decline in the market as they drain liquidity.

Others, however, are enthusiastic that the nuclear divestment, in a key high-tech sector, will be looked on favorably as offering high growth potential.

China has unveiled plans to build more nuclear power plants as part of its efforts to increase non-fossil fuel sources of energy.

The country is expected to raise installed nuclear capacity from 14.6 gigawatts in 2013 to 50 GW by the end of 2017. Among all types of clean energy, however, solar power is expected to see the most rapid growth.

CNNP is not the only upcoming energy opportunity which could tempt investors to cash in on the huge growth prospects for the sector.

Last year CGN Power Co Ltd, China's largest nuclear plant operator in terms of installed capacity, launched an IPO worth $3.2 billion, which made it Hong Kong's largest in 2014.

김대호 기자 tiger8280@

[알림] 본 기사는 투자판단의 참고용이며, 이를 근거로 한 투자손실에 대한 책임은 없습니다.

![[뉴욕증시] 美 상호관세 유예 종료에 '촉각'](https://nimage.g-enews.com/phpwas/restmb_setimgmake.php?w=270&h=173&m=1&simg=2025070606473105083c35228d2f5175193150103.jpg)